ZEITGUIDE TO E-COMMERCE

As the biggest shopping days of the year quickly approach, a growing number of us are now clicking for deals instead of standing in lines.

This growth in e-commerce was perhaps most reflected in the news this year that Amazon finally made profits while big box retailer Walmart surprised Wall Street with flat revenues and a prognosis that revenues could drop as much as 12% in the coming fiscal year.

Here’s another indication: according to the U.S. Commerce Department, the U.S. retail industry grew only 1% between mid-2014 and mid-2015, but online sales increased 14%.

Globally, e-commerce sales are expected to grow 25% during 2015.

With Alibaba in the lead, the first half of 2015 saw e-commerce sales in China jump 30% (although analysts do worry that China’s economic slowdown could affect these sales).

McKinsey & Co. estimates that e-commerce accounts for 4% of luxury sales and is growing three times as fast.

Amazon projected that its fourth quarter sales in 2015 would be 25% higher than 2014. And a new player in the U.S., Jet.com, financed partially by Alibaba, is joining the competition with even lower prices than Amazon.

How can retailers use e-commerce to compete, given the brutal fact that 44% of online product searches start at Amazon?

Social media, perhaps.

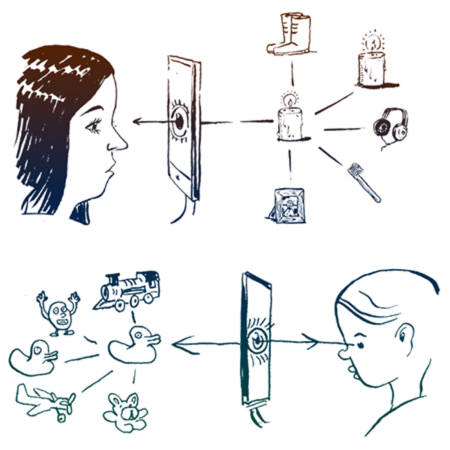

Social media platforms including Facebook, Twitter, Instagram, Google, YouTube,Pinterest and SnapChat are also seeing the great potential of e-commerce, as 54% of shoppers currently compare prices through social media. They also see what their friends are buying and wearing. They are testing “buy buttons.” Social shopping is still in its early days, but streamlining the see-want-buy process—especially on mobile platforms—is in the interest of both sides. This must be great news for retailers like Target, Publix and Walmart, which are particularly adept at leveraging social media—as well as those who lose sales on mobile devices because of cart abandonment.

“It’s still a frustrating process to go all the way through to complete the sale on a mobile device, especially a smartphone,” eMarketer senior analyst Cathy Boyle confirmed. “For retailers, this is a pain point for them. This capability of being able to shop and buy is really critical for them.”

Digital wallets and mobile payment systems are paving the way. Ken Seiff, a former Brooks Brothers executive, sums it up this way: “Mobile shopping is going to be like Tinder, where you can just swipe and get what you want.”