ZEITGUIDE TO THE PLATFORM REVOLUTION

Uber has devastated the taxi industry and, perhaps, the automobile industry with the launching of their driverless car initiative in Pittsburgh. Airbnb threatens hotel and real estate companies. Amazon has retailers like Walmart on the ropes and the media business worried.

The pattern goes beyond mere digital disruption. It’s a complete shift in business models.

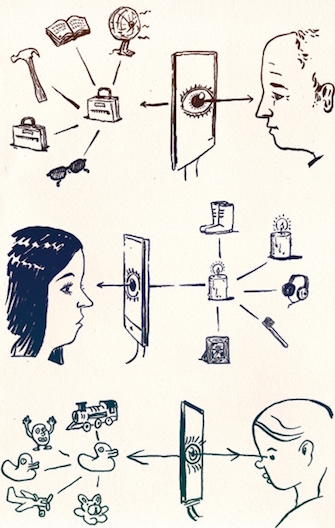

Under the platform model, a company creates a marketplace — usually a digital one — that connects producers or providers to consumers. An obvious example is Uber’s app, which links riders to drivers. But the iPhone is also a platform — providing a device and market for independently developed apps and games that are purchased by iPhone owners.

How do platforms profit? Multiple ways: They take a cut from the transaction (like Apple’s 30% on apps). They add fees (like Airbnb’s 6-12% guest service fee). They charge for a particular type of access to the platform (like LinkedIn does with job recruiters), or charge a subscription fee for enhanced curation of the platform’s users and content.

This powerful new model — the platform — has built-in advantages that lets a new entrant in an industry trounce a competitor that merely makes products. Marshall Van Alstyne, a business professor at Boston U. and co-author of the book Platform Revolution: How Network Markets Are Transforming the Economy and How to Make Them Work for You, told us there are three reasons:

“First, their marginal costs approach zero so they scale much faster. Airbnb and Uber began in 2008 and 2009 respectively but they now have bigger market caps than Marriott and BMW that launched in 1927 and 1916.

“Second, platforms innovate faster by relying on ecosystem partners for external resources. Apple and Google [mobile phones] developed far more value added than Blackberry, Nokia, and LG by harnessing ecosystems.

“Third, platforms are protected by network effects. When users create value for other users, the value proposition scales with use, which creates buyer stickiness.”

On top of all that, platforms often also collect data on their users and use those insights to refine or customize their service.

The advantage is evident in stock market capitalization or investor valuations. Uber is now worth more than GM, $70 billion compared to $47 billion. Netflix isworth more than CBS, $30.6 billion compared to $28.8 billion. Amazon is worth more than Walmart, Target and Cisco combined, $355.5 billion compared to $342.7 billion!

Some businesses are responding by integrating platforms in to their business. This year, GE launched the Predix platform where internal and external software developers create apps that monitor industrial machinery, such as oil-field rigs and wind-farm turbines. In 2012, John Deere introduced MyJohnDeere, a platform for apps and data management related to its agricultural and construction equipment.

Platforms will continue to shape the future of business strategy. As the Platform Revolution authors warned in the Harvard Business Review: “For pipeline firms, the writing is on the wall: Learn the new rules of strategy for a platform world, or begin planning your exit.”