ZEITGUIDE TO SNAPCHAT

The initial public offering of stock for Snap, parent company of Snapchat, is underway. Since its conception in a Stanford dorm room in 2011, the company has enjoyed a meteoric rise. It turned down a $3 billion cash offer from Facebook in 2013, and analysts expect its IPO to be the biggest tech IPO in about three years.

Snapchat lent itself to sending flirtatious photos with discretion in its early days. But it evolved to become a primary communication tool for young users, similar to “what texting was for 10 years ago,” according to Wedbush Securities research analyst Michael Pachter.

The ephemeral nature of the content is central to its success. Messages disappear moments after being opened. Stories, the app’s equivalent to a tweet or Facebook status update, are deleted after 24 hours. That means less clutter and less feeling like you’ll never-catch up. It also better imitates the cadence of real-life conversation, and drives an audience to fresh content daily.

The app’s Discover section also allows users to mindlessly scroll through an endless feed of user generated and content from media brands in a passive manner akin to watching TV. This additional dynamic has led some, including the Wall Street Journal’s Christopher Mims, to ask whether Snapchat may be a way to “reimagine television for the mobile age.”

Its popularity has been pegged as a key influencer in the move to vertical video viewing. Snap Lenses, which allow users to overlay graphics on their photos and videos, are a sort of playful augmented reality. Lenses are also advertisers’ way in with the app’s 158 million users (85% of whom are between 18 and 34). Brands have been said to pay up to $350,000 for one day of a sponsored Lens, making these to digital advertising what Super Bowl ads are to TV.

This big spending from advertisers has fueled revenue growth—$404.5 million in 2016, up from $58.7 million in 2015—but Snap still finished in the red last year, with losses growing to $514.6 million. In its SEC filing for an IPO, it wrote that the company “may never achieve or maintain profitability.” Just being honest? Or a real red flag?

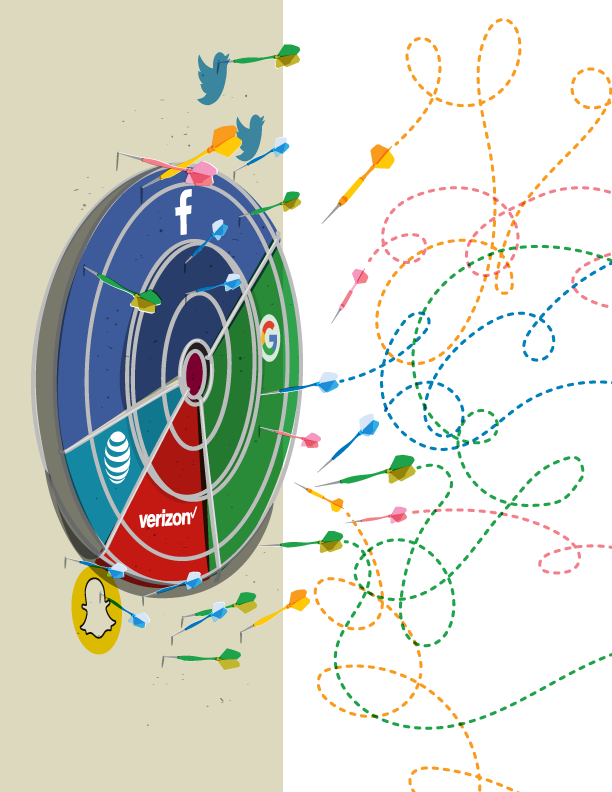

More recently, user growth has slowed, too. Daily active users were up 3% in the fourth quarter of 2016. Last summer, Instagram added its own Stories feature, highlighting how Snap lacks proprietary technology to set the company apart. Among the defectors: Snapchat’s most prolific user, DJ Khaled.

There is also the question of whether its young users will outgrow the app, or if it can maintain relevance with ensuing generations. Think of how quickly Facebook became something not for teenagers, but for their parents.

But amid all this skepticism lies the tantalizing idea that Snapchat is the vanguard of a seismic shift in the way we communicate—which is to say not by call, email or text, but through images.

This perceived shift may be at the root of the company’s insistence that it is a camera company, not a social network or platform.

“We believe that the camera screen will be the starting point for most products on smartphones,” the company wrote in its SEC filing. “This is because images created by smartphone cameras contain more context and richer information than other forms of input like text entered on a keyboard.”

We’ll see if Snap successfully updates an old idiom: A picture is worth a $28 billion market valuation.