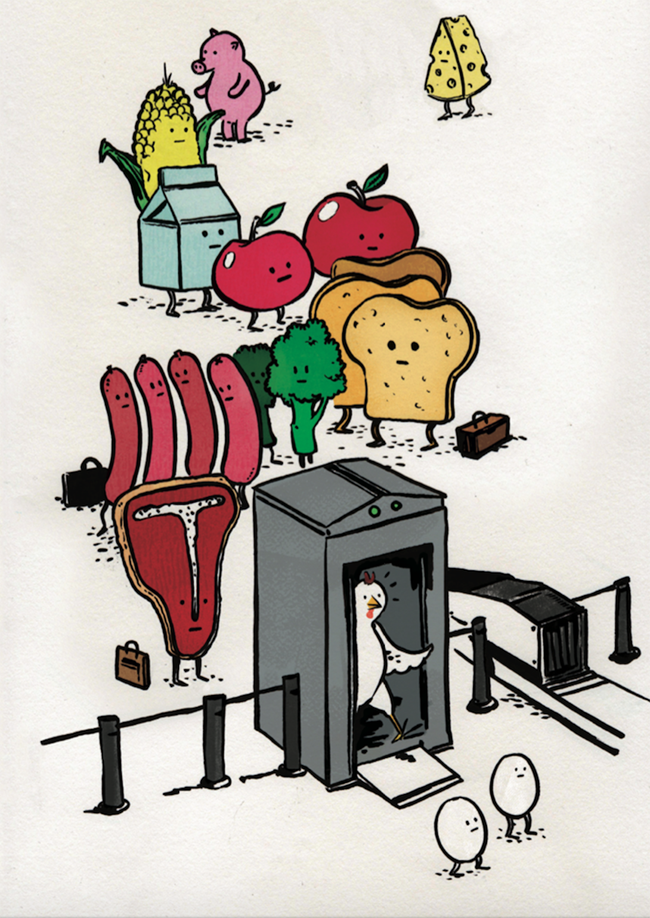

ZEITGUIDE TO FOOD DELIVERY STRUGGLES

Food delivery startups that deliver prepared meals to your door have taken a beating recently. This month New York-based Maple shut down after just two years, some $10 million in debt. SpoonRocket, which prepared and delivered sub-$10 meals in under 10 minutes, got shuttered last year. Munchery is struggling to stay afloat.

Founders of such enterprises expected to shake things up by providing restaurant takeout without the restaurant. Venture capitalists fed their ambitions, pouring $4.1 billion into them in 2015.

“Our whole thing is balanced meals made from the best ingredients at an accessible price,” said Caleb Merkl, Maple’s CEO and co-founder.

Turns out delivering meals that are both appealing and affordable is much harder than expected. In some cases, the costs of delivery, labor, ingredients and kitchen overhead were higher than those of a typical restaurant—already a notoriously low-margin business. Restaurants generally spend 60% of their revenue on food and labor costs combined. Maple’s food costs were equivalent to 63% of its gross revenue in 2015; labor was equivalent to 66%.

Without finding economies of scale or creating a super-efficient supply chain, startups lost money on every meal. Expanding just dug them deeper in the hole. Maple lost $9 million in 2015 and lost the backing of celebrity chef David Chang, who went on to start a competitor. Munchery bled over $120 million over seven years, wastes an average of 16% of the food it makes and has had to recapitalize under a new CEO.

Venture capitalists have scaled back their investments to $1 billion in 2016. The downtrodden have been gobbled up by competitors—part of a consolidation trend across the whole on-demand food space, which includes restaurant delivery services, groceries and meal kits.

One promising niche is providing lunch to office workers. Palo Alto-based Eat Club recently attracted $30 million in investment. By delivering a minimum of 20 lunches to offices all at once, it spends about half as much per meal as on-demand startups.

Also still strong are some of the startups with platform business models—providing delivery for eaters to get food from existing restaurants. That’s a model with lower risk and easier scalability. DoorDash has expanded from San Francisco to Miami, Milwaukee and other major cities. In the first three months of this year, GrubHub has delivered 324,000 orders a day and made $17.7 million in profit, an 80% year-over-year increase.

To paraphrase an old saying, if you can’t take the losses, stay out of the kitchen.