ZEITGUIDE to MEGADEALS

ZEITGUIDE “Finance & Business” Image by Kristofer Porter

2014 could be the year of the M&A megadeal.

While our eyes have been lighting up over the latest funding rounds of some our favorite startups—or staring in disbelief from a $1 billion-plus purchase of a company we never heard of, these deals pale in comparison to the enormous Goliath vs. Goliath deals of 2014.

The giants have awoken. This the-big-getting-bigger culture suggests CEOs are certainly more confident about the economy… and are finally taking action.

Among the monumental events from just this week:

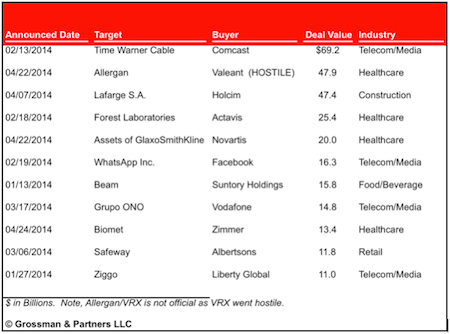

Valeant Pharmaceuticals led by CEO Michael Pearson along with activist investor, Bill Ackman of Pershing Square launched a hostile takeover bid for Allergan, the maker of Botox, worth at least $45 billion. If it succeeds, it’ll be among the biggest mergers this year, which is already off to a frantic start of more than $1 trillion in M&A (below is a chart of top 10 deals of 2014 so far).

In addition, four other deals above $10 billion were announced or rumored this week, including details on a colossal $100 BN Big Pharma merger that seems to have fizzled. We haven’t seen this kind of M&A buzz among giants since before the financial markets imploded in 2008.

It’s a huge shift in sentiment. Last year, corporations were just dipping their toes in the M&A pool—but moves like Valeant’s prove that now they are now jumping in cannonball style. If the Goliaths continue to make waves in 2014, it may be a great year for all those investment bankers or even your stock portfolio likely filled with ripe targets.

It might not, however, be great for consumers—or employees. Valeant, for instance, is known for slashing costs. Fewer players in an industry also can stifle innovation.

Consolidation in telecommunications (read: Comcast-Time Warner Cable) is generating even bigger concerns. The FCC is, yet again, trying to write rules for net neutrality—but it seems inevitable that the giant telcos will be able to squeeze Netflix and others to pay hefty amounts for “fast-lane” treatment on their networks. Not only will that cost likely will be passed along to consumers, start-ups stuck in the slow lane—like new internet gaming or streaming services—might suffer.

We’ll be listening for more insights on this at the upcoming Wired Business Conference, where corporate power and its effects on the economy and politics are sure to be hot topics. Stay tuned.

Keep Learning,

Brad Grossman

Founder, Grossman and Partners

Creator, ZEITGUIDE

P.S. Thank you to Arise360 for featuring us on your show. We loved the blow ups of Kristofer Porter’s art from ZEITGUIDE 2014.

Get ZEITGUIDE 2014 here.