How Retailers Are Fighting Back

The holiday shopping season is right around the corner, and with so many consumer dollars up for grabs, retailers are doing everything they can to get shoppers in store, on their site or using their app.

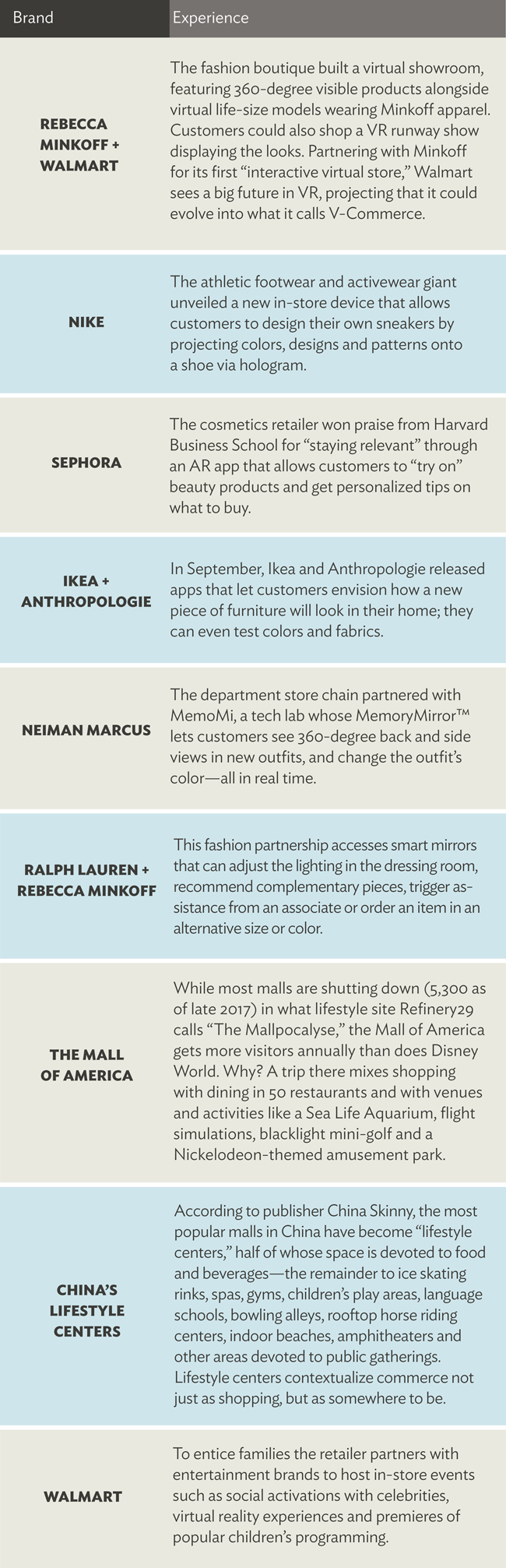

These new approaches continue the blending of digital innovation with physical shopping experiences, or what we like to call “phygital” retail. (You can check out the examples of phygital retail we highlighted in Q1 at the end of this newsletter.)

Here are a few of the more recent moves retailers are making that grabbed our attention.

No Cash or Cashiers

Amazon Go, which debuted its first location in Seattle in January, introduced shoppers to the ability to grab what they want and leave the store, no checkout needed. Sensors automatically detect what shoppers leave with and bill their Amazon accounts. With plans to open as many as 3,000 Go locations by 2021, the stores are another step—along with its Whole Foods acquisition, book stores and its new “4-star” retail outlets—in Amazon’s quest to dominate physical retail as it has ecommerce.

Joining the cashier-less craze will be Walmart when it opens its first Sam’s Club Now location in Dallas. The stores will pilot Walmart’s own cashier-less tech, as well as innovations like an app to navigate customers around the store and highlight product features using augmented reality. 7-Eleven is piloting a Scan & Pay app feature that will enable shoppers to check themselves out via their phones.

In China, where some 525 million people, or 45 percent of the population, use mobile payments, outlets like Alibaba’s Hema supermarkets are incorporating what they call “graze and pay.” This allows grocery shoppers to buy items as they shop and try them out right in the store.

Rethinking the Grocery Store

Per Forrester Analytics, the U.S. online grocery market is expected to balloon from $26.7 billion this year to $36.5 billion by 2022. So grocery chains are competing to make the digital food shopping experience even more convenient. That includes reserved parking and designated checkout lanes for pickup shoppers, or replacing shelves that carry those last second impulse buys by the register with racks for holding orders.

There’s Amazon Prime Now to deliver groceries from Whole Foods to Prime customers in under two hours. Walmart plans to offer grocery delivery to 40 percent of the U.S. by the end of the year and has partnered with Instacart to offer same-day delivery in select markets. The company is also testing out an Uber-like platform called Spark Delivery, which pairs customers with someone who will pick up and deliver their order for them. Kroger has 19,000 employees dedicated to running 1,400 pickup sites in its stores and also offers same-day delivery through a partnership with Instacart.

The New Product Search

The growing popularity of smart speakers has prompted marketers to rethink how customers find their products, going from text-based SEO to VEO. But so far, people predominantly use these assistants for simple functions like setting timers, checking the weather or playing music. A report by The Information found only 2 percent of Amazon Echo owners had used the device to make a purchase in 2018.

Retailers may find more success with visual search, which enables customers to search for products by taking a picture. This ability is still just a small fraction of all searches, but Amazon, Target, Home Depot, Bed Bath & Beyond, West Elm, Wayfair, Neiman Marcus, Macy’s, Asos, H&M and Forever 21 are just a few of the brands that now have visual search built into their apps or ecommerce sites.

Social Shopping

Platforms like Pinterest and Snapchat are also positioning their visual search tools as a seamless way for brands to connect consumers to their products on social media. When Pinterest added a feed that matched products to images posted by users, it boosted traffic to retailers by 40 percent. Instagram has already established itself as an ecommerce alternative for brands that are growing wary of Amazon, as the e-tailer increasingly directs shoppers to its private label brands. And the social data these platforms possess provide useful insight to help brands more accurately hone their messaging based on users’ interests.

Show Me the Loyalty

While loyalty programs are nothing new, the competition for consumer attention and dollars is making them an increasingly important part of retailers’ efforts to maintain their connection with customers and boost sales. Nordstrom’s newly revamped Nordy Club provides members with access to increasingly personalized experiences—like house calls from Nordstrom stylists—the more they spend. Alibaba created a subscription program whose membership price goes down the more someone spends. And spend more they will: Members of Nordstrom’s Nordy Club spend four times as much as non-members.

As a reminder, check out the examples of retail innovation we published in our Q1 digest in January. Stay tuned for more updates on the retail industry with the Q1 edition of our 2019 quarterly almanac, coming in the new year.

Want to learn more about ongoing business and cultural transformation?

Subscribe to our quarterly cultural almanac that synthesizes all the hot-button issues you need-to-know.

Sign up to receive our newsletters and binge read all of our previous culture briefings.

Bring us into your organization for crash courses and custom content to get you and your team smart on need-to-know subjects.

ZEITGUIDE is your guide to the zeitgeist, German for “spirit of the times”: The go-to source business and creative leaders rely on to stay smart, culturally relevant and ahead of the future. We keep you up to speed on the constant shifts impacting your business and lead you towards what’s next. Contact us if you would like us to produce learning programs and content customized to your needs.