ZEITGUIDE TO FUTURE BUSINESS

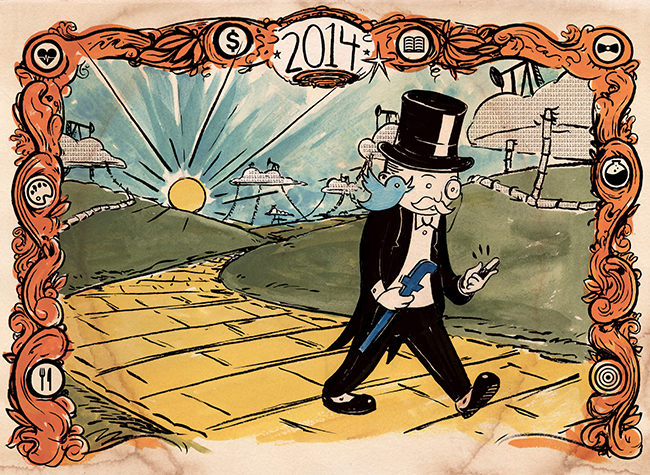

ZEITGUIDE “BUSINESS TRANSFORMATION” IMAGE BY KRISTOFER PORTER

In ZEITGUIDE 2014 and our weekly newsletters, we guide you through leading-edge issues that are changing our culture, our world, and our businesses. We speak with subject-matter experts, scour the news media, and dig deep into research to distill the material most vital to keeping leaders like you relevant, connected, and prolific.

This week, we want to make sure The Wall Street Journal’s fall business outlook section was on your radar. It contained multiple articles on topics of interest to us. Among the key points:

Total U.S. GDP is growing, but on the household level, things are murky.

Revenue at big companies is up, but retail spending was flat this summer and household spending declined. Consumer spending represents two-thirds of the US economy, unless American consumers resume purchasing spending, the recovery could remain tepid.

There are more jobs open, but employers are slow to fill them.

Job openings reached 4.7 million in June, the highest number since 2001. But the 25 working days that is the average to fill a position? That’s at a 13-year high as well. The WSJ attributes slow hiring to a combination of employer trepidation and the new demands of applicant screening in an era of online job boards.

Car sales are up, but automakers are still nervous.

Future sales could be hurt by a rise in interest rates, volatility in emerging markets (where 60% of car sales happen now), and innovative new competitors like Tesla who are surging ahead on technology, efficiency, and safety.

China isn’t the hero it seemed to Hollywood. Yet.

Box office revenue is off 15% in the US, but studios won’t make that loss up in China. Why? Not all box office dollars are equal. In the US, studios recoup about 50 cents of gross ticket sales. In China it’s 27 cents. And China’s market doesn’t have a mature secondary market of video-on-demand, Netflix, DVDs, cable, etc.

TV ad sales are way down, but TV execs aren’t panicking. Yet.

They believe the soft upfront is a result of advertisers’ reserving budgets for “scatter” (ad time bought during the fall TV season). The WSJ concurs with what we’re hearing from our advertising clients: No one wants to commit to ad budgets months in advance when they have “new automated ad-buying technologies and the flexibility of social media to decide on ad buys shortly before they want to run.”

Texas is producing a glut of oil. New places like North Dakota and Alabama are also pumping oil and gas.

But with limited pipelines and political pressure against building more, getting that oil to market is a challenge. Refineries are the beneficiaries of lower prices right now. Consumers are unlikely to see prices drop at the pump because they are impacted by the wider global market.

Chinese e-commerce company Alibaba may have the biggest IPO ever.

It could go as high as $220 billion, unlike anything seen since the last internet bubble. Two other tech events that may affect both culture and business are Apple’s launch of iPhone 6, and the pending FCC’s verdict on net neutrality.

US manufacturers are finally using their cash.

But not on hiring or on equipment. Instead they are spending on acquisitions and stock buybacks. The average age of industrial equipment in the US is over 10 years old, the highest since 1938. Without upgrades, U.S. firms may soon struggle to compete with foreign rivals.

The Affordable Care Act gets its second open-enrollment period in November.

The Congressional Budget Office estimates that 13 million will enroll in health plans for 2015 through the insurance exchanges. Insurance companies envision getting more young individuals enrolled as penalties kick in, but they could lose small-business customers who might opt to send employees to the exchanges. (Wellpoint lost more than 200,000 small business clients January to July.) Large companies, meanwhile, might start to scale back health plans in anticipation of the 2018 tax on higher-cost plans.

Good luck with all the challenges that lie ahead, but most importantly…

Keep Learning,

Brad Grossman

Creator, ZEITGUIDE

Founder, Grossman & Partners

__________________________

P.S. We have added a share feature to the newsletters that enables you to show off your exclusive ZEITGUIDE membership and new knowledge.

And for those of you who didn’t get a chance to purchase the limited editions of ZEITGUIDE 2014, an e-book version and paperback version is now available on Amazon .