ZEITGUIDE TO SAUDI ARABIA

A booming market for renewable energy has emerged in one of the world’s most oil-rich countries: Saudi Arabia. The country plans to invest around $7 billion by the end of the year in seven solar plants and a wind farm.

This, as part of a continuing political, social, and cultural transformation, is led by the 32-year-old Crown Prince Mohammed bin Salman. The Crown Prince, with his Vision 2030 initiative, is aiming to reduce the country’s dependence on oil and build a more innovative, entrepreneurial and inclusive economy.

To achieve these ambitious goals, the Crown Prince has been aggressive in consolidating power. Last fall, he detained dozens of perceived policy opponents, including princes, clerics and some of the richest men in the world. Prince Alwaleed bin Talal, well-known for his sizable investments in Lyft and Twitter, just recently—at the end of January—secured his own release from prison (though in his case prison was a Ritz Carlton hotel).

MbS has also pushed back on the power of the conservative religious establishment and many of the laws it has imposed on Saudi society. The country’s religious police has been stripped of its ability to make arrests. A 35-year ban on commercial films was lifted in December, to the glee of Saudi cinephiles. In June, women will gain the right to drive, an important civil rights victory that is also expected to have immediate economic benefits as women can now more easily enter the workforce. Uber has already recruited its first women drivers in the country.

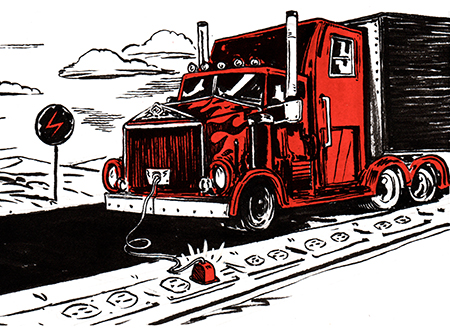

As for the country’s economic transformation, moving to renewable energy will have a few immediate benefits. Solar technology advances make it a cheaper alternative to burning oil. Extreme heat creates a big dependence on air conditioning, and the country’s power plants go through some 680,000 barrels of oil a day to meet peak energy demand in the summer months.

Reducing its domestic oil use will free the country to export more. How will demand keep up with that supply is another question. Saudi Arabia is hardly the only country, after all, embracing renewable energy.

And so, Saudi Arabia is pushing to diversify its economy. There are potential deals with Alphabet to develop a tech hub in the country, as well as with Amazon to build data centers. Aramco, the state owned oil company, may be taken public. Its market cap is projected to be around $1.5 trillion, twice that of Apple’s. A sale of even a small percentage of its stock would provide additional cash to fuel investment in new industries.

A move away from oil dependence could have profound effects on Saudi society. It’s the profits from state-owned oil that have funded the extravagant lifestyle of the royal family, but also healthcare for the country’s citizens. Should other industries fail to make up for lost oil revenue, what then?

2018 will provide more insight into the impact of a transforming Saudi Arabia, and whether the Crown Prince’s ambitions point to improved prospects for the country—or instability ahead.

Want to learn more about the global shifts that could impact your business?

#GetSmartQuick with ZEITGUIDE 2018.

Inquire about our custom offerings.

Sign up to receive our weekly newsletter.